The global maize market is experiencing a shift as the anticipation of a substantial crop begins to materialize, leading to a decline in prices. This trend is underscored by reports from various international bodies, despite the temporary absence of official data from the United States due to its government shutdown.

The United Nations Food and Agriculture Organization (FAO) noted a month-on-month fall in maize prices, attributing this to forecasts of abundant supplies in key exporting countries like Brazil and the United States. Additionally, the temporary suspension of grain export taxes in Argentina has contributed to the downward pressure on maize quotations. This price adjustment reflects the market’s response to expected surplus supplies, which is a typical reaction in commodity markets when supply outstrips demand.

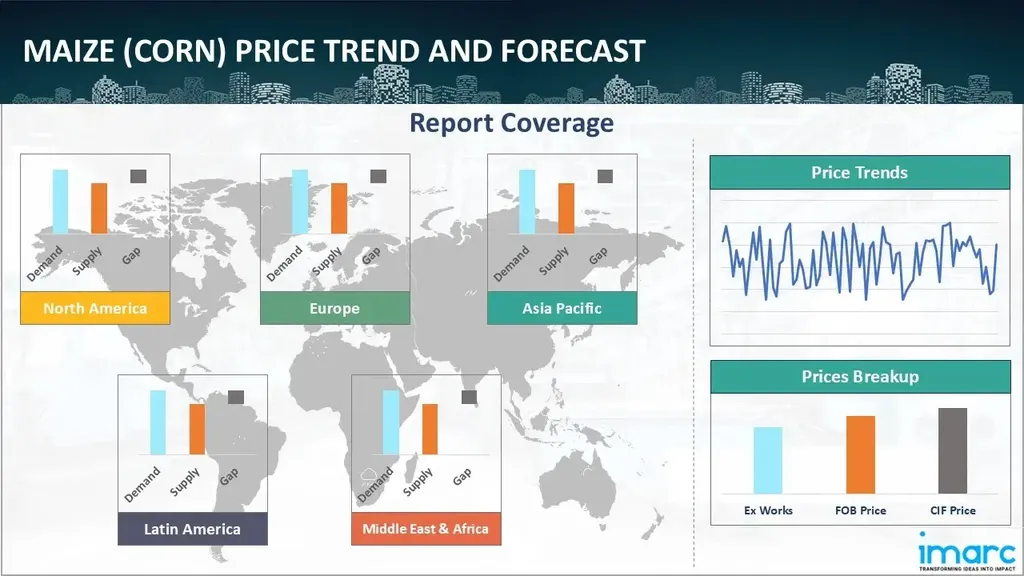

The Agricultural Market Information System (AMIS) further elaborated on the expected maize production for 2025, which has been revised upwards since September. This revision is primarily driven by upward adjustments in Brazil and the United States, despite declines in the EU and Mexico. The anticipated production is now expected to be 6.5% above the 2024 level. This abundance of maize supplies is projected to support higher feed usage in both producing and importing countries, leading to an upward revision in trade for the 2025-26 season.

The current harvesting season in the Northern Hemisphere is ongoing, with Brazil nearing completion of its summer-planted crop, which has seen exceptional yields. Sowing conditions for the spring-planted crop in Brazil are also reported to be favorable. Similarly, favorable conditions are noted for China’s ongoing harvest of summer-planted crops and India’s Kharif season crop, with a significant increase in total sown area compared to last year. In the United States, the harvest is ramping up with above-average yields expected in the northwestern Corn Belt and the Southeast.

However, the situation is not uniformly positive across all regions. In Europe, drought and repeated heatwaves in southeastern Europe have led to yield losses in countries like Bulgaria, Hungary, and Romania. In Ukraine, harvesting is beginning under mixed conditions due to prolonged drought in the southern and eastern regions. In Russia, harvesting is progressing under mostly favorable conditions except in the south due to reduced soil moisture.

FranceAgriMer, the French national agency for agricultural and seafood markets, echoed these observations in its monthly report. It noted that while the harvest is expected to reach a new record, with figures continuing to rise for Brazil and the United States, there is a decline in the EU. The drought is also likely to weigh on production in Australia. Despite the absence of a new USDA report, record global harvests for wheat and maize seem to be confirmed.

For agritech and investors, these developments present both opportunities and challenges. The abundance of maize supplies could lead to increased investment in agritech solutions aimed at improving efficiency and yield in maize production. This could include technologies for precision agriculture, drought-resistant crop varieties, and advanced irrigation systems. Additionally, the focus on feed usage could spur innovations in animal feed production and management.

However, the challenges posed by climate-related yield losses in certain regions highlight the need for resilient agritech solutions. Investors may need to consider the risks associated with climate change and the potential for regional yield variability. Diversifying investments across different regions and technologies could help mitigate these risks.

In summary, the current maize market dynamics underscore the importance of agritech innovations in enhancing productivity and resilience. For investors, a balanced approach that leverages the opportunities presented by abundant supplies while addressing the challenges of climate change will be crucial.