The shifting dynamics in the U.S. electricity sector, driven by the growing demand from data centers and the subsequent rush to build natural gas power plants, have significant implications for the agriculture sector and investors.

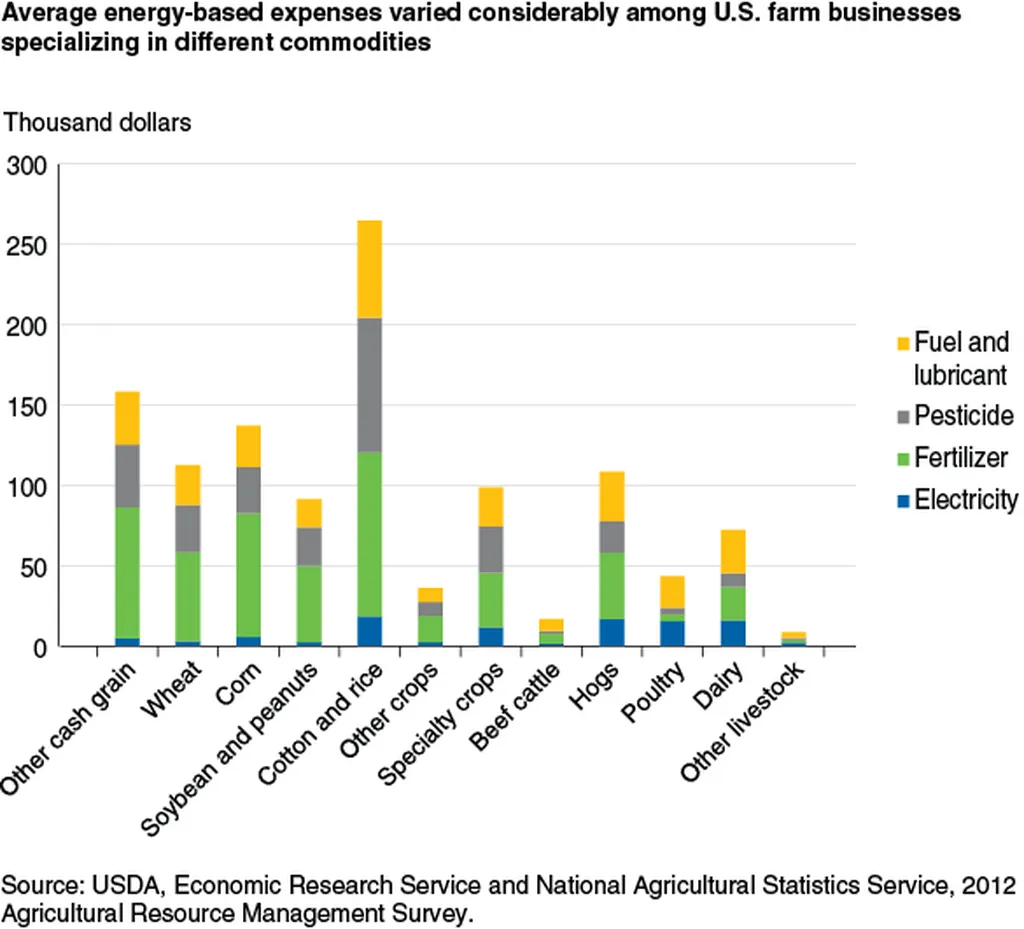

For the agriculture sector, the increasing electricity demand and the potential rise in electricity bills could have several impacts. Farmers, who are already grappling with rising input costs, could face higher energy bills, which could squeeze their already thin profit margins. This is particularly true for large-scale agricultural operations that rely heavily on electricity for irrigation, lighting, and other farm operations. Moreover, the increased demand for natural gas could also lead to higher prices for natural gas-derived fertilizers, further increasing input costs for farmers.

The agriculture sector could also be indirectly affected by the environmental implications of the increased reliance on natural gas. The rush to build gas power plants could lead to increased emissions, which could exacerbate climate change. This, in turn, could lead to more extreme weather events, such as droughts and floods, which could disrupt agricultural production and supply chains.

For investors, the shifting dynamics in the electricity sector present both challenges and opportunities. On one hand, the rush to build gas power plants could provide investment opportunities in the natural gas sector. However, investors should be cautious, as the long-term viability of these investments could be at risk due to the growing push for cleaner energy sources and the potential for stricter regulations on emissions.

On the other hand, the growing interest in batteries and demand flexibility presents significant investment opportunities. As Jigar Shah points out, batteries can provide a more cost-effective and flexible solution for meeting peak demand, and they can also help integrate renewable energy sources into the grid. Investors could benefit from investing in battery storage technologies, as well as in companies that are developing innovative solutions for demand flexibility.

Moreover, investors should also consider the potential for policy changes that could favor cleaner energy sources and demand flexibility. For instance, regulators are increasingly taking notice of the arguments for using batteries and demand flexibility to meet peak demand. This could lead to policies that favor these solutions over traditional gas power plants, creating a more favorable environment for investors in these areas.

In conclusion, the shifting dynamics in the U.S. electricity sector have significant implications for the agriculture sector and investors. While the rush to build gas power plants presents some opportunities, the long-term trends favor cleaner energy sources and demand flexibility. Investors should carefully consider these trends and the potential for policy changes when making investment decisions. Meanwhile, the agriculture sector should brace for potential increases in energy and input costs, and consider ways to mitigate these risks.