The Zacks Manufacturing – Farm Equipment industry is navigating a complex landscape marked by near-term challenges and long-term opportunities. Despite weak commodity prices and lower crop receipts, the industry is poised to benefit from increased demand for agricultural equipment driven by global population growth and the need for mechanization.

AGCO Corp. and Lindsay LNN are well-positioned to capitalize on this demand. AGCO has been focusing on strategic transformation, investing in products, precision farming technology, and smart farming solutions. The company’s efforts to streamline its portfolio and enhance digital capabilities have driven margin expansion. Notably, AGCO completed a significant agricultural technology deal to create the PTx Trimble joint venture, merging it with its Precision Planting business to form PTx. This move boosts AGCO’s competitive edge and long-term prospects.

Lindsay, on the other hand, reported 11% revenue growth in fiscal 2025, driven by higher irrigation and infrastructure revenues. The company’s acquisition of a 49.9% minority interest in Pessl Instruments GmbH is expected to accelerate innovations in water management and expand its global reach. Lindsay’s Road Zipper System, gaining popularity for its faster implementation and lower costs, also positions the company for growth.

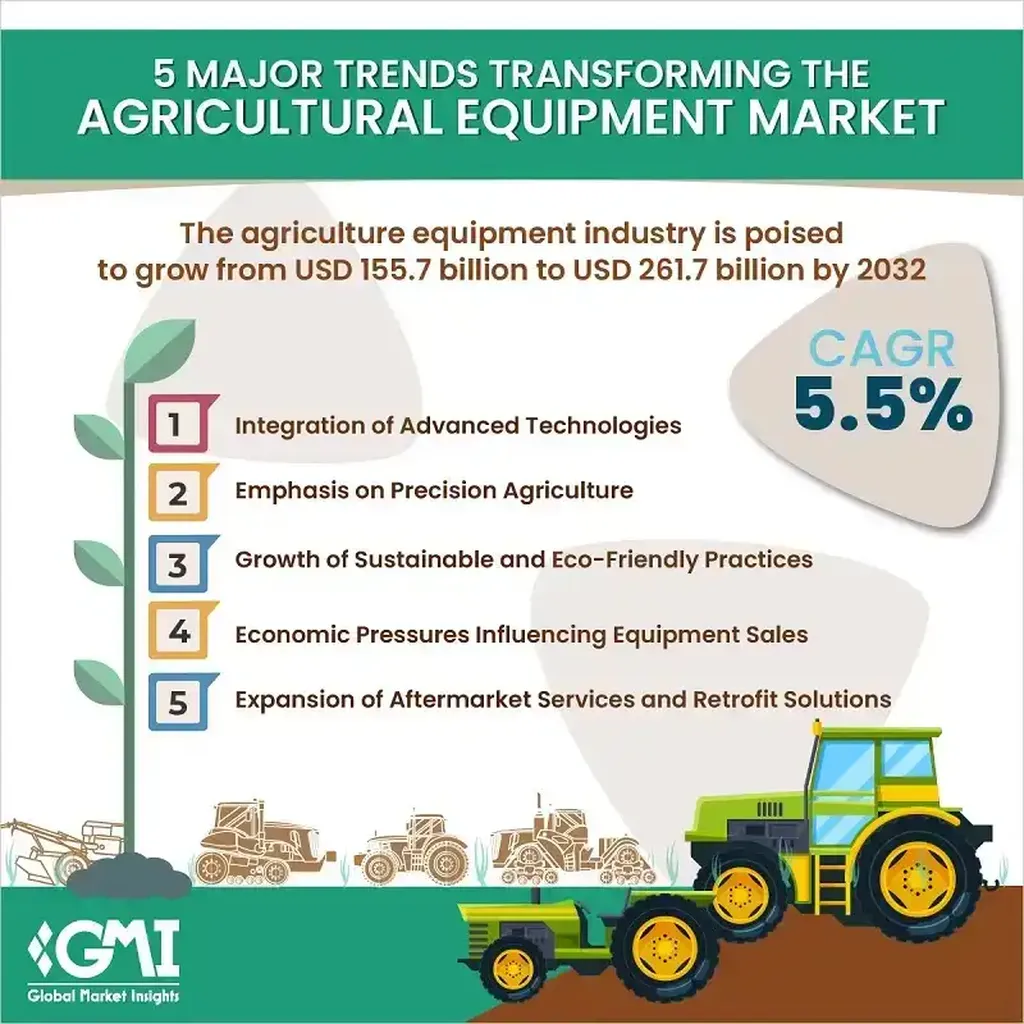

The industry’s future is further bolstered by the increasing demand for technologically advanced machinery. Precision agriculture technology, in particular, is expected to be a key catalyst, enabling farmers to increase yield with reduced input costs and sustainability benefits. Companies like Deere & Company DE and CNH Industrial CNH are also investing heavily in upgrading their technology offerings.

However, the industry faces near-term headwinds. The Zacks Manufacturing – Farm Equipment industry currently carries a Zacks Industry Rank of #220, placing it at the bottom 9% of 243 Zacks industries. This ranking indicates dim prospects in the near term. Additionally, the industry has underperformed the broader market over the past 12 months, with stocks gaining 11% compared to the S&P 500’s growth of 16.5%.

Despite these challenges, the industry’s long-term outlook remains promising. The increasing demand for food, driven by population growth and aspiring living standards, will continue to fuel the need for agricultural equipment. Moreover, subsidies on agricultural machinery purchases are enabling even small-scale farmers to invest in equipment, further supporting industry growth.

In conclusion, while the near-term outlook for the Zacks Manufacturing – Farm Equipment industry is marred by weak commodity prices and lower crop receipts, the long-term prospects remain bright. Companies like AGCO and Lindsay are well-positioned to capitalize on the increasing demand for agricultural equipment and technologically advanced machinery. Investors should keep an eye on these industry players as they navigate the current challenges and capitalize on future opportunities.