In the vast and vibrant world of global aquaculture, shrimp farming stands as a titan, contributing a substantial one-third to the annual seafood trade. Yet, this industry, which fuels foreign exchange earnings for major producer countries, is under constant siege from a trifecta of risks: biological, climatic, and market. A recent study published in *Frontiers in Sustainable Food Systems* sheds light on how insurance strategies can transform these risks into resilience, particularly in India and beyond.

The study, led by Ravisankar T. from the CAR-Central Institute of Brackishwater Aquaculture (ICAR-CIBA) in Chennai, Tamil Nadu, India, delves into the intricate world of shrimp aquaculture insurance. It highlights the critical role insurance plays in safeguarding farmers against losses from natural disasters and crop diseases, thereby promoting income stability and encouraging sustainable farming practices.

Shrimp farming is no stranger to crises. Viral pathogens like the White Spot Syndrome Virus (WSSV) and microsporidian infections such as Enterocytozoon hepatopenaei (EHP) can decimate farms overnight. Add to this the unpredictability of cyclones, floods, and global price volatility, and it’s clear why insurers have been hesitant to offer coverage. “The inherent vulnerability of aquaculture limits the interest of insurers,” explains Ravisankar T., underscoring the challenge at hand.

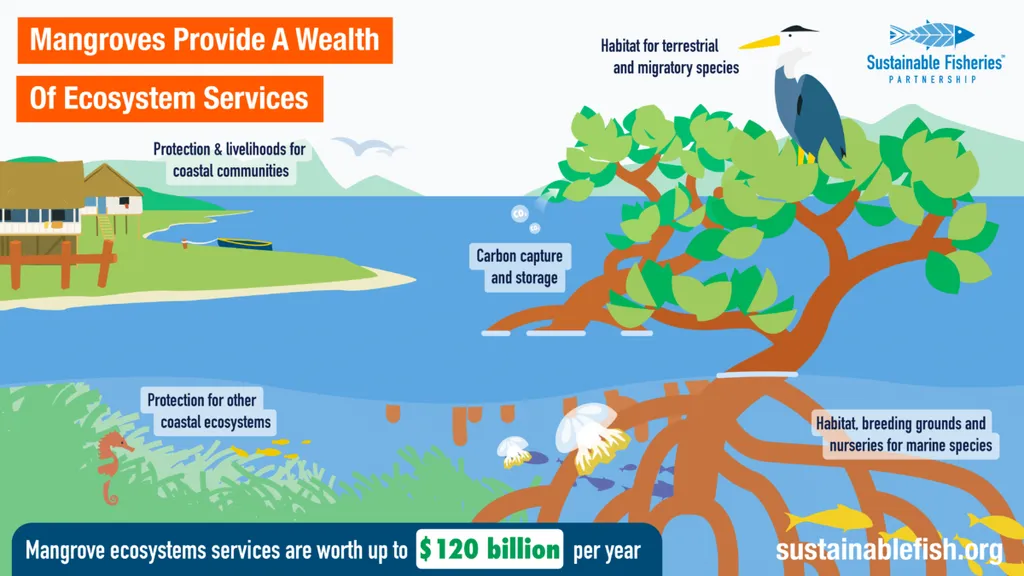

However, the study reveals that insurance is not just a safety net but a crucial mechanism for achieving several Sustainable Development Goals (SDGs). By providing financial protection, insurance can reduce poverty (SDG 1), enhance food security (SDG 2), and promote climate action (SDG 13). It’s a tool that builds resilience in coastal rural communities, helping them weather the storms of climate change.

The review synthesizes global experiences with indemnity and parametric insurance models, evaluating challenges and adoption rates across countries. It presents a detailed case study of India, exploring different insurance policy models and the role of regulatory agencies. The study also highlights modern scientific measures like Better Management Practices (BMPs) and digital technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and satellite imaging. These innovations reduce risk and enable efficient loss assessment for swift claim settlement.

Recent efforts to revitalize Indian shrimp crop insurance products through institutional and industry linkages have shown promise. Enhanced participation of farmers and other stakeholders is key to the success of these initiatives. The study advocates for policy alternatives such as insurance-linked credit flow, government-supported re-insurance, group insurance, and affinity insurance for sustainable aquaculture insurance.

Challenges remain, including low awareness, limited parametric adoption, and historical disease outbreaks. However, the study offers key lessons emphasizing government support, premium subsidies, digital monitoring systems, and coordinated stakeholder partnerships. These findings provide actionable guidance for policymakers, insurers, and other stakeholders aiming to design effective, inclusive, and sustainable shrimp aquaculture insurance frameworks globally.

The recommendations focus on subsidized premiums, streamlined claims processes, and farmer education programs. As the study concludes, the path forward involves a concerted effort to build a resilient shrimp aquaculture sector that can withstand the vagaries of nature and market fluctuations.

In the ever-evolving landscape of global aquaculture, this research offers a beacon of hope and a roadmap for transforming risk into resilience. It’s a testament to the power of innovation and collaboration in building a sustainable future for shrimp farming.