In western Pennsylvania, a significant shift in energy infrastructure is underway, with major implications for the agriculture sector and investors. The transformation of the former Homer City coal-burning power plant into a large-scale gas-fired facility, designed to power multiple data centers, highlights the region’s pivot towards supporting data center industries. This shift could have profound effects on the agricultural landscape and investment opportunities.

The development of data centers and the associated energy infrastructure could lead to increased competition for land use. The Homer City facility, for instance, is part of a 3,200-acre “energy campus,” which could otherwise be utilized for agricultural purposes. As more data centers are planned, the demand for large tracts of land may intensify, potentially reducing the availability of land for farming and other agricultural activities. This could be particularly concerning in a region where agriculture has been a traditional and vital part of the economy.

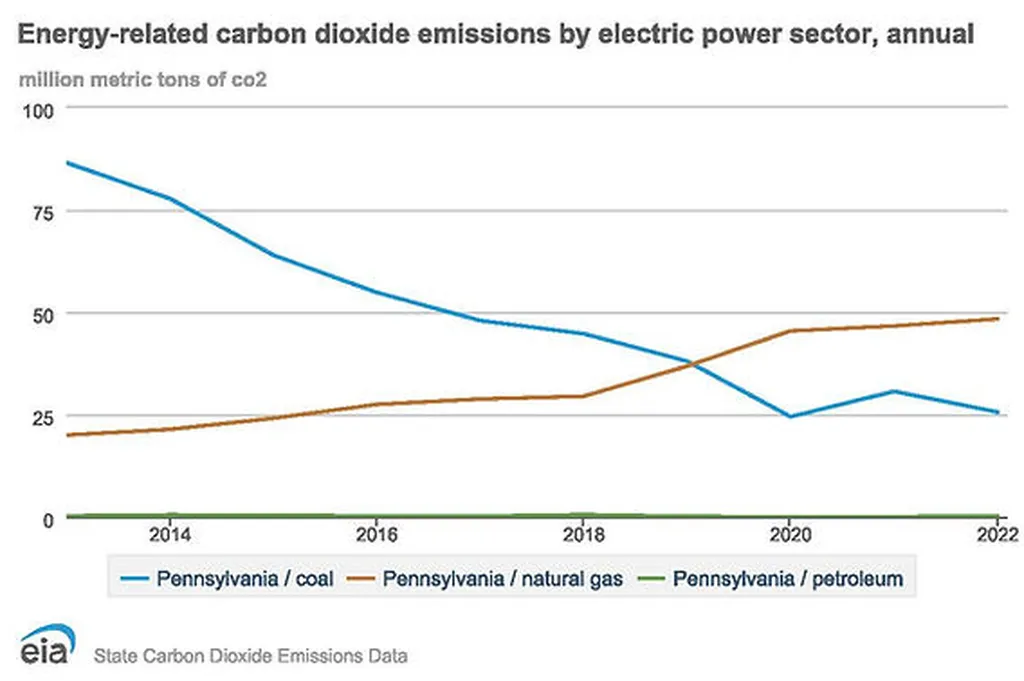

Moreover, the energy demands of data centers are substantial. The Homer City facility alone is expected to consume an amount of energy equivalent to that used by 3.2 million homes annually. This increased demand for energy could drive up costs, affecting not only residential consumers but also the agricultural sector, which relies heavily on affordable energy for irrigation, processing, and transportation. Higher energy costs could squeeze profit margins for farmers and agricultural businesses, potentially leading to reduced investment in the sector.

For investors, the data center boom presents both opportunities and risks. On one hand, the growth of data centers could spur investment in energy infrastructure, including gas-fired power plants and renewable energy projects aimed at meeting the sector’s energy demands. This could create new avenues for investment in energy production, transmission, and distribution. Additionally, the development of data centers themselves could attract significant capital investment, potentially boosting local economies and creating jobs.

On the other hand, investors must consider the environmental and regulatory risks associated with this shift. The expansion of fracking to meet the energy demands of data centers has raised concerns about air and water pollution, as well as the long-term sustainability of water resources. These environmental impacts could lead to stricter regulations, increased operational costs, and potential legal challenges, all of which could affect the profitability of investments in the energy and data center sectors.

Furthermore, the reliance on natural gas as a primary energy source for data centers could expose investors to market volatility and price fluctuations. The natural gas industry is subject to regulatory changes, market demand shifts, and geopolitical factors, all of which can impact the supply and price of natural gas. Investors must carefully assess these risks and consider diversifying their portfolios to mitigate potential losses.

In conclusion, the transformation of energy infrastructure to support the data center industry in western Pennsylvania has significant implications for the agriculture sector and investors. While the data center boom could drive economic growth and create new investment opportunities, it also poses risks related to land use, energy costs, environmental impacts, and market volatility. Stakeholders must carefully weigh these factors and consider sustainable and balanced approaches to development to ensure long-term benefits for the region’s economy and environment.