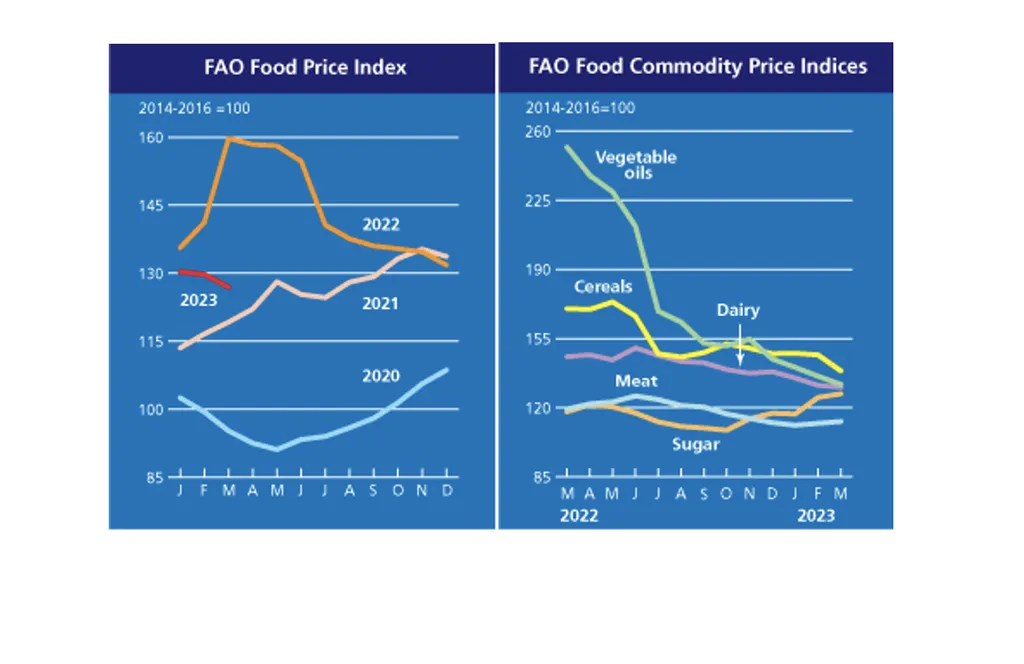

The Food and Agriculture Organization (FAO) of the United Nations has reported that the benchmark global food commodity index has fallen for the fourth consecutive month in December. The FAO Food Price Index (FFPI) dropped to 124.3 points, which is less than 1% lower than the November value. The declines in the price indices for dairy products, meat, and vegetable oils more than offset the increases in cereals and sugar. The index was 3 points (2.3%) below its level one year ago and nearly 36 points (22%) below the peak reached in March 2022. For the year 2023, the index averaged 127.2 points, 5.2 points (4.3%) higher than the 2022 average despite the recent declines.

The Cereal Price Index (CPI) averaged 107.3 points in December, up 1.8 points (1.7%) month on month. For the year, the CPI averaged 107.9 points, down 5.6 points (4.9%) from the previous year and marking the lowest annual average since 2020. Renewed concerns over Black Sea export flows lent support to international wheat prices, but the FAO said markets remained pressured down by ample supplies, with confirmation of large crops in Argentina and Australia reinforcing the downward trend.

By contrast, world maize (corn) markets were boosted by robust export demand and strong domestic ethanol production in both Brazil and the United States, while sorghum prices rose in tandem with maize despite a slow pace of sales to China, the world’s major importer of sorghum, the FAO noted.

The All Rice Price Index increased by 4.3% as prices increased across all rice market segments due to a combination of reduced harvest pressure, improved demand, and supportive policy measures. The All Rice Price Index averaged 103.5 points in 2023, down 35% from 2022, reflecting downward pressure on rice quotations from ample available exports, intense competition among exporters, and reduced purchases by some importing countries in Asia, the FAO said.

The Vegetable Oil Price Index averaged 164.6 points in December, down 0.4 points (0.2%) from November and marking a six-month low. The FAO said the decline reflected lower world prices of soy, rapeseed, and sunflower oils, which more than offset higher palm oil quotations. Global soy oil prices declined on ample export supplies from the Americas, while larger rapeseed outputs in Australia and Canada exerted downward pressure on rapeseed markets. For sunflower oil, sluggish global import demand due to weakening price competitiveness contributed to price contractions for the second consecutive month in December. By contrast, international palm oil prices edged up slightly, largely underpinned by prospective seasonal production slowdowns in Southeast Asia, outweighing the impact of higher-than-expected outputs and inventories in Malaysia in late 2023.

The Vegetable Oil Price Index averaged 161.6 points in 2023, up 23.6 points (17%) year on year and marking a three-year high amid tight global supplies.

Other highlights from the report included: The Meat Price Index averaged 123.6 points in December, down 1.7 points (1.3%) from its revised November value, but still 4.1 points (3.4%) above its level a year ago. Prices declined across all meat categories, with those of bovine and poultry meats falling the most. The Dairy Price Index declined by 5.9 points (4.4%) in December as butter prices fell sharply, driven by seasonally higher cream availability in Europe and stock accumulation following strong production earlier in the year. The Sugar Price Index averaged 90.7 points in December, up 2.1 points (2.4%) from November after three consecutive monthly declines, but it remained 28.6 points (24%) below its level a year ago.

Implications for Agritech and Investors

The decline in the FFPI and CPI indicates a stabilization of global food commodity prices, which could have significant implications for agritech and investors. The decrease in prices for dairy, meat, and vegetable oils suggests that there is a surplus in these markets, which could lead to a decrease in investment in these areas. However, the increase in the All Rice Price Index and the Cereal Price Index indicates that there is still demand for these commodities, which could be an opportunity for investors to diversify their portfolios.

The decline in the Vegetable Oil Price Index could be an opportunity for agritech companies to