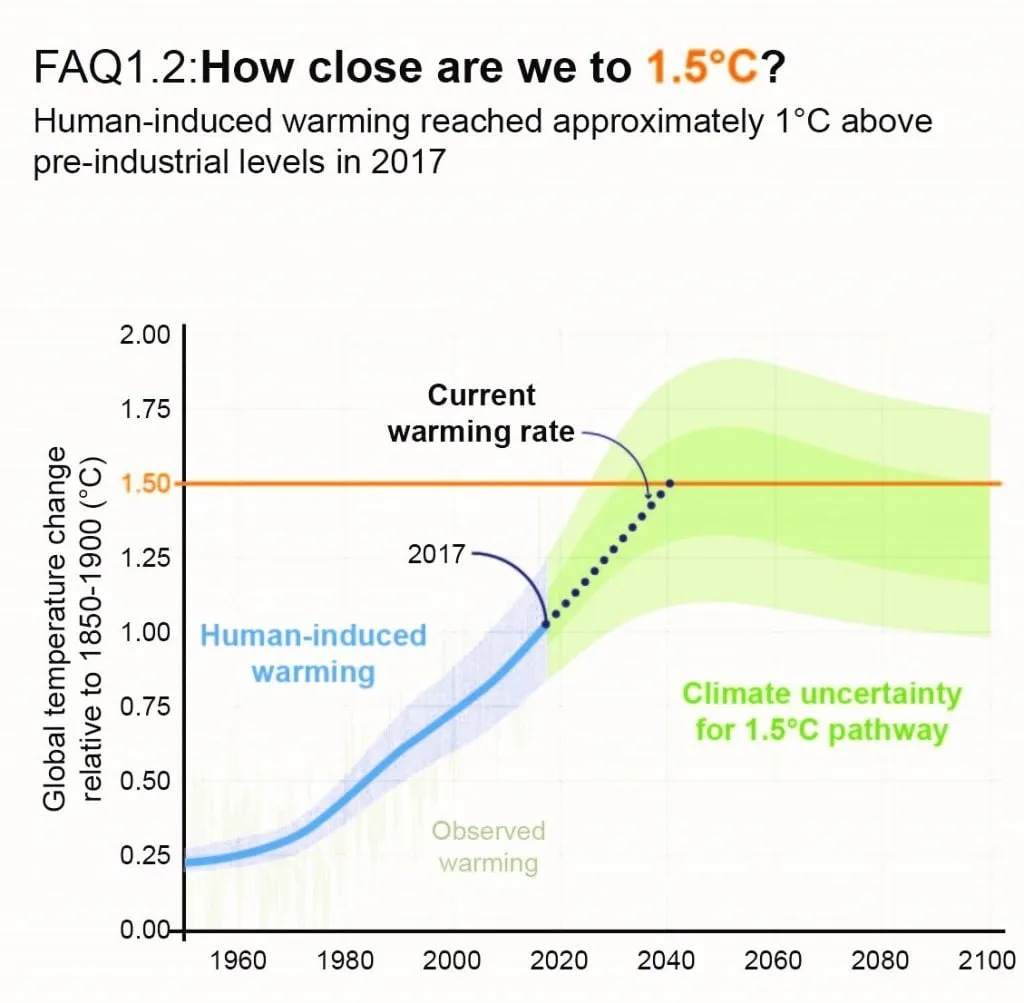

The world is on the brink of overshooting the critical goal of limiting average global warming to 1.5 degrees Celsius, as a three-year period ending in 2025 has already breached this threshold. This alarming development is accompanied by dire predictions from climate scientists, who warn of devastating consequences, especially as global governments seem to have lost momentum in addressing the emissions driving this warming.

The 1.5-degree target, established at the Paris climate conference a decade ago, was intended to mitigate severe weather impacts and prevent runaway warming that could trigger irreversible planetary tipping points. However, climate scientists assert that a decade of inadequate action has rendered the goal unattainable. Robert Watson, a former chair of the Intergovernmental Panel on Climate Change (IPCC), bluntly states, “Climate policy has failed. The 2015 landmark Paris agreement is dead.”

The implications of this overshoot are profound, particularly for the agriculture sector and investors. The sector, which is highly sensitive to climatic conditions, faces a multitude of challenges. Rising temperatures, erratic weather patterns, and increased frequency of extreme weather events such as droughts, floods, and wildfires threaten crop yields and livestock health. These disruptions can lead to food insecurity, price volatility, and supply chain interruptions, impacting both producers and consumers.

For investors, the implications are equally significant. The agricultural sector, which includes farming, agribusiness, and food production, is a major economic driver. However, climate-induced disruptions can lead to financial losses and reduced profitability. Investors need to be aware of these risks and consider the resilience of their investments in the face of climate change. Diversification, sustainable practices, and investment in climate-resilient technologies and crops can mitigate some of these risks.

The current situation is exacerbated by the weakening of natural carbon sinks, such as oceans and forests, which have historically absorbed a significant portion of human-emitted CO2. Recent studies indicate an “unprecedented” weakening of these sinks, partly due to increased wildfires and heat stress on trees. This reduction in the Earth’s ability to absorb CO2 accelerates the rise in atmospheric concentrations of the greenhouse gas, further intensifying global warming.

The potential for a domino effect, where crossing one tipping point triggers others, adds another layer of complexity. For instance, the predicted death of the Amazon rainforest could release billions of tons of CO2, while the melting of Arctic permafrost would unlock vast amounts of methane, a potent greenhouse gas. These developments could make it significantly harder to recover from the overshoot, according to researchers.

The escalating impacts of climate change are already evident in the form of soaring heatstroke deaths, unprecedented wildfires, and escalating property damage from tropical storms and extreme precipitation. The economic toll is substantial, with extreme weather linked to climate change costing the global economy over $2 trillion in the past decade, according to the International Chamber of Commerce.

Looking ahead, the situation is likely to worsen. James Hansen, a renowned climatologist, predicts that we could hit 2 degrees Celsius of warming as soon as 2045 under a high-emissions scenario. This escalation is driven by a combination of stubbornly high emissions and weakening natural carbon sinks.

For the agriculture sector and investors, the message is clear: the time to act is now. Proactive measures, such as adopting sustainable practices, investing in climate-resilient technologies, and diversifying portfolios, are crucial to navigating the challenges posed by climate change. The window for effective action is closing rapidly, and the consequences of inaction are dire. As Johan Rockström, a leading earth systems scientist, warns, “Nature has so far balanced our abuse. This is coming to an end.”