In the ever-evolving landscape of agricultural technology, a new study published in *Frontiers in Sustainable Food Systems* is making waves by exploring how InsurTech—insurance technology—can drive the development of agricultural insurance, particularly in China. The research, led by Dainan Hou from the School of Business at Minnan Normal University, delves into the intricate relationship between InsurTech, farmers’ disposable income, and regional heterogeneity, offering insights that could reshape the future of agricultural insurance.

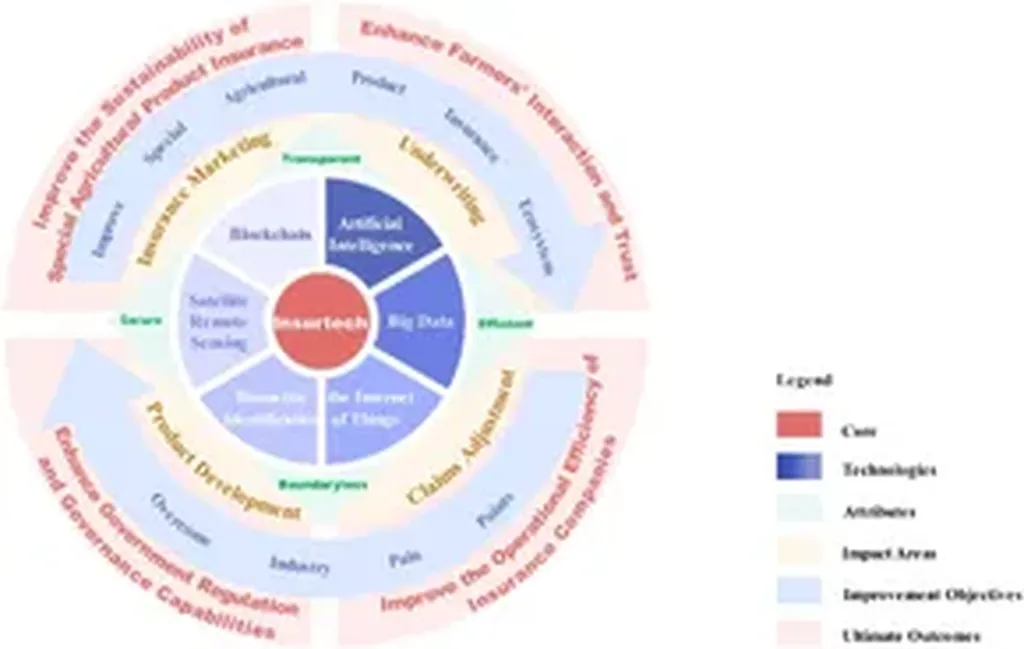

The study leverages cutting-edge technologies such as artificial intelligence (AI), big data, cloud computing, and the Internet of Things (IoT) to address longstanding challenges in agricultural insurance, including underwriting, pricing, and claims processing. By integrating theoretical frameworks like the Bayesian Signal Extraction Model and insurance pricing models, the research proposes mechanisms through which InsurTech can influence the development of agricultural insurance.

Utilizing provincial-level panel data from 31 provinces in China spanning from 2011 to 2023, the study employs a two-way fixed effects model to identify the impact of InsurTech on agricultural insurance development. The findings are robust, supported by various tests including alternative dependent variables, instrumental variable methods, and propensity score matching (PSM).

One of the most compelling discoveries is the significant positive impact of InsurTech on agricultural insurance development. “InsurTech significantly promotes agricultural insurance development,” states the study, highlighting the transformative potential of these technologies. The research also reveals that this promotional effect is more pronounced in non-major grain-producing areas, suggesting that InsurTech could be a game-changer for regions that have traditionally lagged behind in agricultural insurance penetration.

Perhaps the most intriguing finding is the “double threshold” effect of farmers’ disposable income. The study shows that when farmers’ income exceeds approximately 6,008 RMB and 12,842 RMB, the marginal effect of InsurTech’s promotion gradually intensifies. This nonlinear relationship underscores the importance of considering income levels when designing agricultural insurance policies.

The commercial implications of this research are substantial. For the agriculture sector, the adoption of InsurTech could lead to more efficient and accurate risk assessment, streamlined claims processing, and ultimately, more affordable and accessible insurance products for farmers. This could enhance financial stability for farmers, encouraging greater investment in agricultural technologies and practices that boost productivity and sustainability.

The study also calls for the enhancement of digital infrastructure in agricultural insurance and the development of regionally differentiated policies. By tailoring insurance products to the specific needs and characteristics of different regions, the agriculture sector can better mitigate risks and foster growth.

As the agriculture sector continues to grapple with the challenges posed by climate change, market volatility, and technological disruption, the insights from this research offer a beacon of hope. By harnessing the power of InsurTech, the agriculture sector can build a more resilient and sustainable future, ensuring that farmers are better protected against the uncertainties that lie ahead.

In the words of the study, “This research provides empirical evidence for enhancing the digital infrastructure of agricultural insurance and the development of regionally differentiated policies.” As we look to the future, the integration of InsurTech into agricultural insurance could very well be the rising tide that lifts all boats in the agriculture sector.